Your Ultimate Investment Checklist: Key Fundamentals from a Former Hedge Fund PM

Empty Your Cup: Letting Go of Preconceptions

The Zen concept of "emptying your cup" encourages us to let go of preconceptions and biases before embracing new information. This principle is vital in our dynamic world where clinging to outdated beliefs hinders our ability to adapt.

In a world where we’re constantly inundated with information from all corners of the physical and digital world, it becomes important to

Prioritize: Discern valuable information from the noise.

Evaluate: Critically assess the credibility and relevance of sources.

Assimilate: Integrate new knowledge thoughtfully into our existing understanding.

This task becomes even more difficult once we contend with the proliferation of a) fake news b) assumed authority figureheads and personalities and c) byte-sized sensationalist media that is personalised to our interest through the help of AI hallucinations

In the world of public markets and investments and the very real and physical world around us, it becomes important to utilise two tools to help us along the way

A framework for evaluating authority: Determine who is deserving of your trust, and your most important investment – your time & attention

A checklist for recognizing bias: Ensure your decision-making isn't unduly influenced by others' preconceptions.

This approach is essential whether you're navigating the investment world or simply making choices in everyday life.

My investment Checklist

“One list to rule them all”

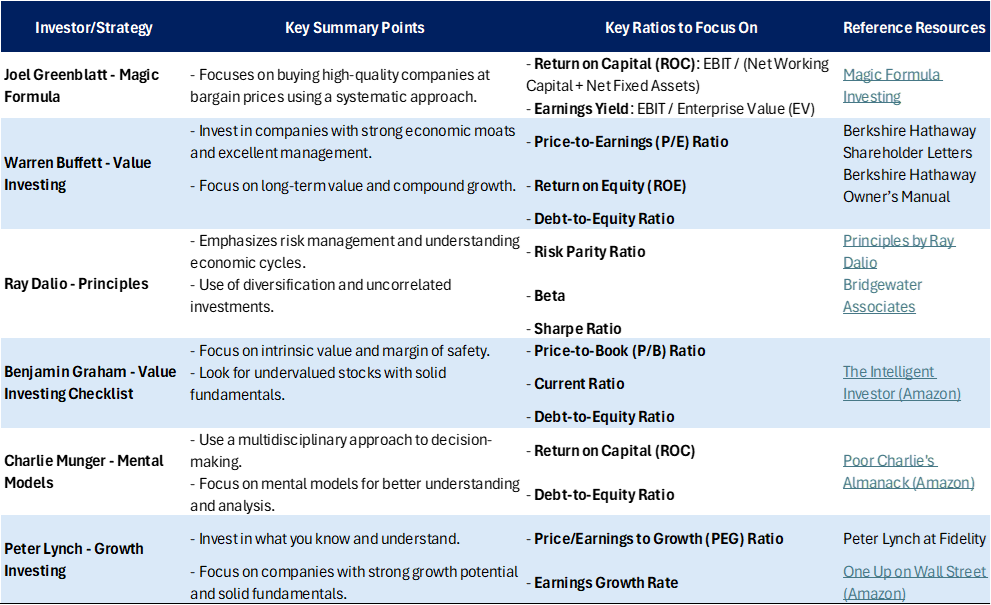

A summary table of key fundamental focal points from leading successful investors:

My checklist for stock selection based on fundamentals:

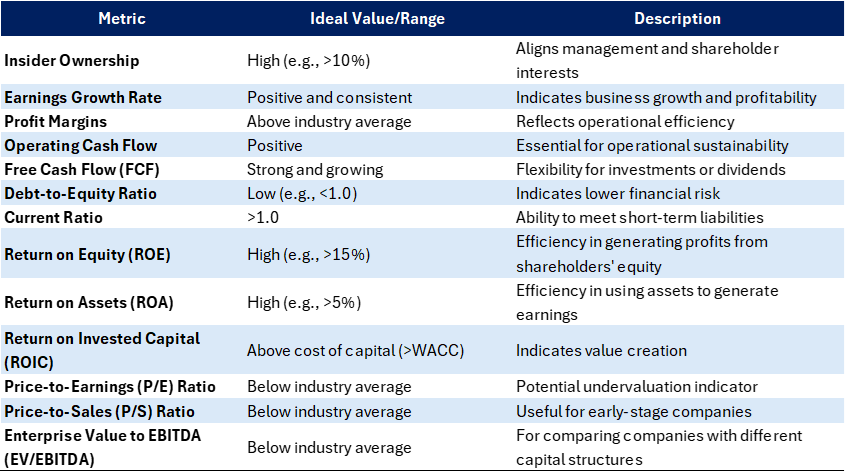

✅ High Insider Ownership

✅ Recent Insider Buying

✅ Balanced Institutional Ownership

✅ Consistent Earnings Growth

✅ High Profit Margins

✅ Positive Operating Cash Flow

✅ Strong Free Cash Flow (FCF)

✅ Steady / Strong Revenue Growth

✅ Diversified Revenue Streams

✅ Low Debt Levels

✅ High Liquidity Ratios (Current Ratio >1.0)

✅ High Return on Equity (ROE)

✅ High Return on Assets (ROA)

✅ Strong Return on Invested Capital (ROIC)

✅ Attractive Valuation Metrics (Low P/E, P/S, EV/EBITDA)

✅ Market Leadership Position

✅ Significant Investment in R&D

✅ Strong Management Team

✅ Resilience to Macroeconomic Factors

✅ Favourable Competitive Landscape

Note this is a non-exhaustive list of checklist items and as a checklist serves as key items to look out for rather than to eliminate ideas

*a brief explainer on the importance of these follows at the bottom of the post.

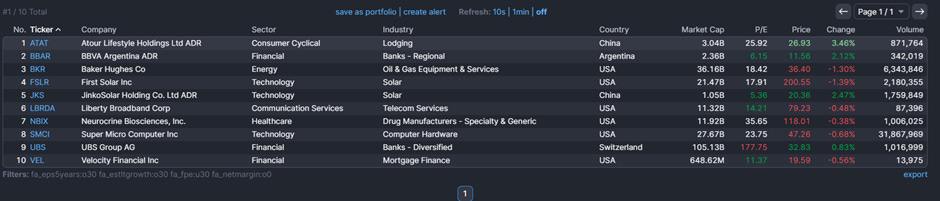

Table of Key Stats

Here’s the actual table!

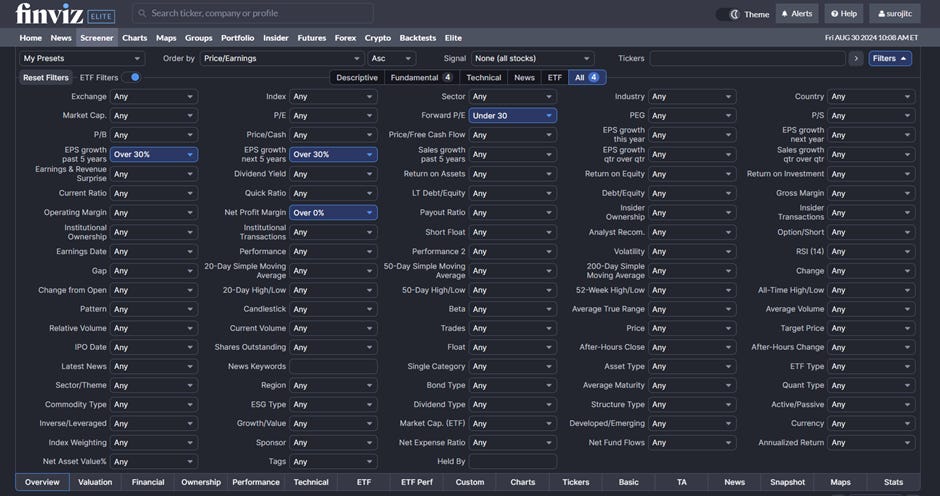

And finally to get the ball rolling with a mini-screening exercise:

A Preliminary Screen starting with a fundamentals first approach

- I’m using Finviz Elite to assist me with my screen here

- Initial screening filters applied

o EPS growth >30% (past & present)

o Profitable companies (Net Income margins >0%)

o Valuations that could merit exploring further (P/E <30)

TECHNICALS

- Looking through the list of 10 names, I will apply a price-action-centric lens to assess if any of the names merit a deeper look

Based on a visual review

I’m looking out for

Prices at or near supports

Prices within tight ranges (volatility contractions)

Last 12month price action showing either flat-ish moves (in the range) or higher highs & lows

Target focus list here:

1. BBAR

2. FSLR

3. NBIX

4. SMCI

5. VEL

—> We’re going to follow these names and develop the thesis further in subsequent posts alongside deep dives into my broader investment process

Understanding Fundamental Factors and Metrics: Why They Matter

(Provided here on a non-exhaustive basis)

High Insider Ownership: Indicates that management and insiders have a significant stake in the company, aligning their interests with shareholders.

Recent Insider Buying: Suggests that insiders are confident in the company’s future prospects.

Balanced Institutional Ownership: Reflects professional investors' confidence while maintaining room for growth potential.

Consistent Earnings Growth: Shows a company’s ability to expand its business and increase profitability over time.

High Profit Margins: Suggest the company is operating efficiently and has strong pricing power in its market.

Positive Operating Cash Flow: Essential for maintaining business operations and funding growth internally.

Strong Free Cash Flow (FCF): Provides flexibility for investments, acquisitions, or returning capital to shareholders.

Steady Revenue Growth: Indicates robust demand for the company’s products or services, suggesting future growth potential.

Diversified Revenue Streams: Reduces dependence on a single product or market, lowering risk.

Low Debt Levels: Implies less financial risk and greater stability in various market conditions.

High Liquidity Ratios (Current Ratio >1.0): Ensures the company can meet short-term obligations without financial strain.

High Return on Equity (ROE): Demonstrates efficient use of shareholders' equity to generate profits.

High Return on Assets (ROA): Reflects the company’s ability to use its assets effectively to produce earnings.

Strong Return on Invested Capital (ROIC): Shows the company’s ability to generate returns above its cost of capital, indicating value creation.

Attractive Valuation Metrics (Low P/E, P/S, EV/EBITDA): May indicate the stock is undervalued compared to its peers or historical averages.

Market Leadership Position: Companies in leading market positions often have competitive advantages and greater growth potential.

Significant Investment in R&D: Indicates a commitment to innovation and long-term growth, particularly in technology and biotech sectors.

Strong Management Team: Essential for strategic planning, execution, and adapting to changing market conditions.

Resilience to Macroeconomic Factors: Low sensitivity to economic downturns or sector-specific risks provides stability.

Favourable Competitive Landscape: Assess the company’s position relative to competitors to gauge its potential for sustained growth and market share.

Keep learning, and stay curious. Profitably yours.🐎

Disclaimer