My Process

A Few Key Tenets:

Investment success is repeatable.

There are many ways to generate investment returns.

Opportunities arise from the interplay between subjective and objective measures of value.

The pursuit of asymmetric opportunities is intellectually stimulating.

Only the flexible survive

A Mosaic of Decision Tools

I use a variety of tools and frameworks to guide my investment decisions. The following elements play a crucial role in creating enduring investment returns:

Human Psychology: Understanding the interplay between emotions and opportunities.

Risk-Reward Approach: Adopting a calculated and disciplined strategy to manage risks and rewards.

Capital Management: Balancing growth opportunities with protective strategies to optimize risk & return.

Deep Dive into Human Psychology

Economics 101 Essentials 📊

Understanding Supply and Demand

The classic strategy: Buy low, sell high 📉📈

Follow the trends in buying and selling 🚀

Identifying Repeatable Patterns 🔄

Recognizing key phases in investment opportunities

Spotting signals before a significant stock movement 🔍

Key Indicators in Stock Movement

Fundamentals: Detecting value gaps between intrinsic value and market price 💼

Technicals: Identifying key price levels where stocks typically rebound 📈

Price Action: Analyzing price and volume to confirm buying or selling momentum 📊

Emotional Interplay in Markets

Balancing greed versus fear 🤑😅

Navigating FOMO (Fear of Missing Out) against loss aversion 💸

Deep Dive into Technicals

Mastering Technical Patterns 📉

Identifying successful technical setups with favourable risk-reward ratios

Leveraging high-volatility scenarios using tools like Average True Ranges and volatility bursts 🌊

Integrating Fundamentals and Technicals

Combining technical patterns with fundamental catalysts like earnings releases, M&A, and sector-specific events 💡

Capital Management

Focused Risk Management Strategies ⚖️

Implementing strict discipline to avoid significant losses

Utilizing asymmetric opportunities in capital structure or upcoming events to enhance return-to-risk ratios 📈💥

Other Factors

Leveraging Options and Cross-Asset Opportunities

Creating durable returns through the strategic use of options and other asset classes 🛠️

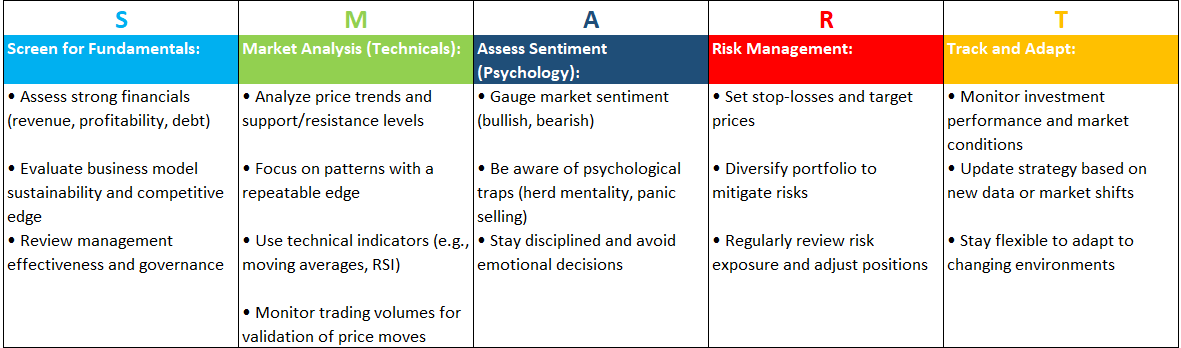

I use the S.M.A.R.T. framework to analyze both potential and current investments. This framework acts as a complementary checklist to the set of tools mentioned above.

I don’t believe in the following myths and constraints, which I’ve learned can truly limit success:

Technical analysis doesn’t work.

You must always be invested in the market.

A successful portfolio must be either highly diversified (15-20 names) or very concentrated (2-4 names).

In certain market environments, there are no opportunities.

Brokerage costs and overtrading are more important than absolute performance.

We can’t time the market.

Disclaimer